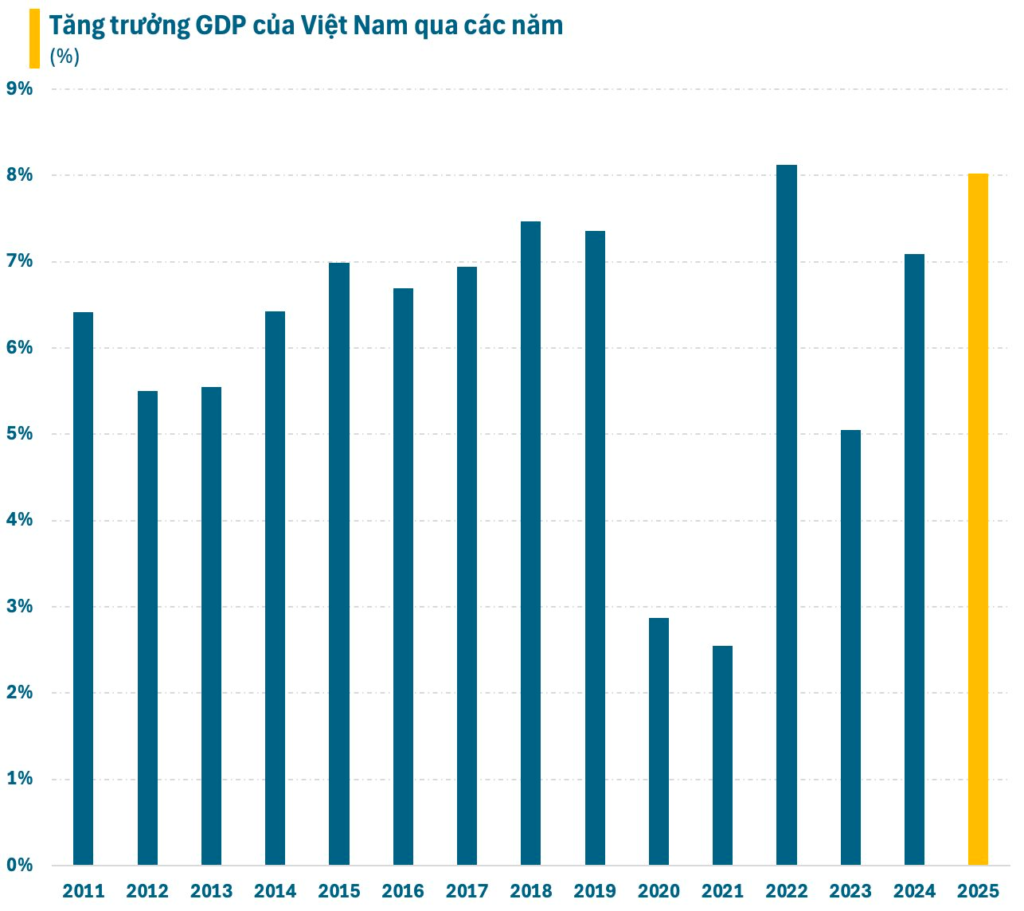

Amid persistent global economic uncertainties, strong growth underpinned by a stable macroeconomic environment is set to become a key advantage positioning Vietnam as an attractive investment destination. The new growth cycle in Vietnam’s era of advancement concluded in 2025 with all 15 out of 15 socio-economic development targets met or exceeded. Most notably, GDP growth reached 8.02%—the second-highest level during the 2011–2025 period—driven primarily by the services sector and industrial manufacturing.

This performance has made Vietnam a bright spot as the global economy continues to face significant challenges, particularly trade tensions and reciprocal tariff policies from the United States. Vietnam recorded the highest growth rate in ASEAN and ranked among the world’s leading growth performers. In 2025, GDP at current prices was estimated at USD 514 billion, equivalent to a per capita income of USD 5,026, placing the country in the upper-middle-income group.

These achievements form a solid foundation for Vietnam to enter a new era of growth, with an ambitious target of double-digit GDP expansion from 2026 onward. To realize this goal, expansionary fiscal policies will continue, with high levels of public investment disbursement focused on strategic transport infrastructure, energy, logistics, and urban development.

At the same time, monetary policy is being managed flexibly to maintain relatively low and stable interest rates, supporting businesses and stimulating domestic consumption. The legal and regulatory environment is also undergoing significant improvements, particularly in key areas such as real estate, capital markets, and digital assets.

Against a backdrop of ongoing global uncertainty, strong growth anchored in macroeconomic stability will remain Vietnam’s competitive edge as an investment destination. A young population and a rapidly expanding middle class are expected to lay the groundwork for investment channels to enter a new growth cycle.

Equities: The Focal Point for Medium- and Long-Term Capital Flows

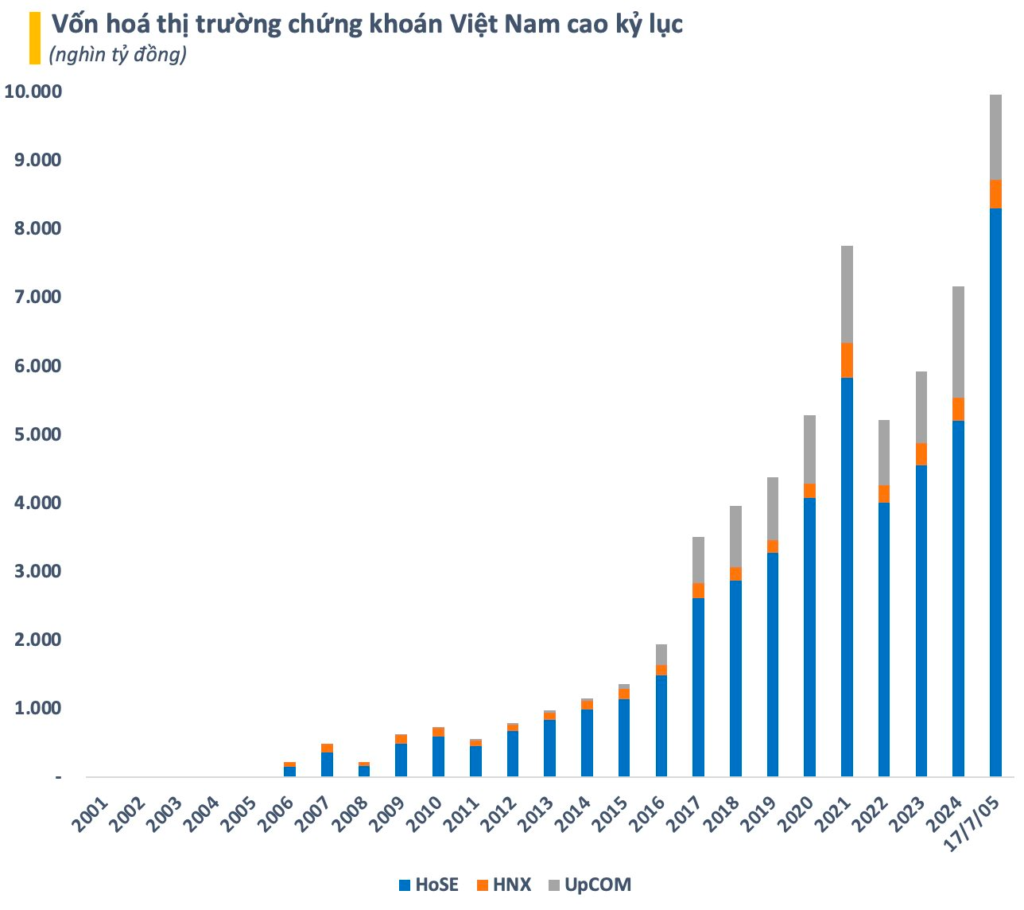

Vietnam’s stock market recorded strong growth in 2025, with the VN-Index reaching new highs and total market capitalization approaching VND 10 quadrillion. However, market performance remained highly polarized, with gains concentrated in select stocks, leaving many investors facing continued challenges. This dynamic is expected to shift as Vietnam’s equity market enters 2026 with significant growth opportunities.

With an ambitious target of double-digit GDP growth, equities are expected to benefit directly from a favorable macroeconomic backdrop in 2026. Economic stimulus measures are likely to drive a meaningful recovery in corporate earnings, particularly across key sectors such as banking, infrastructure construction, consumer goods, and technology.

Foreign Capital Inflows and the Path to Emerging Market Status

Beyond domestic drivers, Vietnam’s stock market stands to gain from rising foreign capital inflows as the pathway toward an upgrade to emerging market status becomes increasingly tangible. Improved liquidity, the stable operation of the new trading system, and ongoing reforms in information disclosure and corporate governance are set to enhance the market’s overall attractiveness to global investors.

Strong Macroeconomic Foundations Support Earnings Growth

According to Dragon Capital, Vietnam enters 2026 with solid macroeconomic fundamentals, characterized by sustained high growth, controlled inflation, and a more prominent role played by the private sector. These factors provide a strong foundation for corporate earnings growth. Continued infrastructure spending, robust FDI inflows, and a rapidly expanding domestic investor base are expected to support capital accumulation and improve market efficiency.

A Core Channel for Long-Term Capital Allocation

Looking ahead, the stock market is expected to further strengthen its role as a key medium- and long-term capital channel for the economy. Sustainable market growth will create favorable conditions for investors to identify attractive return opportunities. Nevertheless, prudent risk management remains a critical consideration.

Gold and Silver: Safe Havens in a Volatile World

Gold recorded a remarkable rally in 2025, with prices rising by nearly 65%. As the world continues to face geopolitical risks, monetary policy volatility, and mounting global public debt, gold has maintained its role as a traditional safe-haven asset. The growing trend among central banks to increase gold reserves and reduce reliance on the U.S. dollar has further supported gold prices.

Many major global institutions forecast that gold prices could continue to rise, as the key drivers behind the metal show no signs of easing. Policy initiatives such as ending the monopoly on gold bullion, allowing banks to participate, and establishing a gold exchange are also expected to contribute to a healthier and more transparent market.

Silver: A More Accessible Precious Metal with Industrial Upside

Meanwhile, silver has emerged as a compelling alternative. While sharing safe-haven characteristics similar to gold, silver is significantly more affordable. Beyond its role as a precious metal, silver is a critical input for industrial applications, particularly in renewable energy and advanced technologies. As these sectors continue to expand, many leading institutions anticipate a positive outlook for silver prices amid severe supply shortages.

However, silver’s pronounced price volatility also introduces considerable risks for investors, requiring a higher tolerance for market fluctuations.

Precious Metals Cycles: Momentum Persists Until Fundamentals Shift

Assessing market prospects, Mr. Widmer, Head of Metals Research at Bank of America (BofA), noted that strong upward cycles in gold and silver do not end simply because prices have risen sharply, but rather when the underlying drivers begin to weaken. He emphasized that despite the significant gains seen in recent periods, precious metals remain underrepresented in global investment allocations, particularly within professional portfolios.

Real Estate: Entering a Phase of Selective Recovery

Vietnam’s real estate market is showing clear signs of recovery. Persistently low interest rates, together with the gradual resolution of legal and regulatory bottlenecks, are creating conditions for both supply and demand to return to the market. However, a wait-and-see mindset among buyers remains evident, particularly as income growth has yet to accelerate meaningfully.

According to Dr. Tran Dinh Thien, 2026 will mark the point at which the real estate market begins to operate on a more sustainable footing, as both developers and investors adopt a more cautious and realistic approach to decision-making. The market’s recovery is closely tied to the overall health of the economy, with public investment and institutional reforms playing a particularly critical role.

Institutional Reforms to Address Structural Challenges

Sharing this view, Mr. Nguyen Van Dinh, Chairman of the Vietnam Association of Realtors (VARS), noted that existing shortcomings in the real estate sector are expected to be gradually resolved during the 2026–2027 period. This will be driven by the government’s comprehensive reform agenda, ranging from improving institutional frameworks and strengthening market discipline to accelerating digital transformation, enhancing supervision, and strictly addressing violations.

2026: A Pivotal Year for Market Transition

Overall, 2026 is widely regarded as a pivotal year for Vietnam’s real estate market, marking a transition toward a phase of selective recovery. Affordable housing, industrial real estate, logistics, and properties linked to transportation infrastructure are expected to be the main bright spots. In contrast, the high-end and purely speculative segments may require additional time to absorb existing supply.

Capital Rotation and Portfolio Allocation in a New Investment Cycle

More broadly, 2026 opens a promising investment landscape, supported by positive macroeconomic fundamentals and Vietnam’s strong determination to achieve robust growth. In this context, capital is likely to rotate flexibly across asset classes, prioritizing investments that offer both return potential and long-term exposure to economic growth. Thoughtful portfolio allocation—balancing safety and growth—will be key for investors seeking to capitalize on the emerging cycle.

FChoice 2025 and the 2026 Investment Outlook Forum

n response to this demand, CafeF, a financial and economic information platform under VCCORP, will host the FChoice 2025 Awards Ceremony alongside the conference titled “Drivers of Double-Digit Economic Growth and Investment Opportunities in 2026”, scheduled for January 13, 2026. The event will recognize outstanding enterprises while serving as a forum for in-depth discussions on the conditions needed for Vietnam to move closer to its goal of achieving over 10% growth during the 2026–2030 period.

Key topics to be addressed include removing bottlenecks from traditional growth drivers, unlocking new development spaces, and identifying investment channels within the emerging growth cycle.